London, Sept 2 (V7N) – With Wall Street closed for the Labor Day holiday, global financial markets followed independent paths on Monday. Asian equities posted notable gains, led by Chinese tech stocks, while European shares ended mostly flat and long-term bond yields in Europe remained elevated due to fiscal concerns.

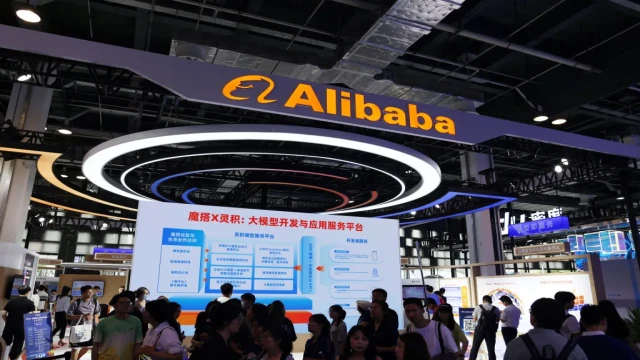

The pan-European STOXX 600 index rose slightly by 0.1%, as early optimism following improved manufacturing data gradually faded. In contrast, Hong Kong-listed shares of Chinese tech giant Alibaba soared 18.5% after the company reported a strong surge in cloud revenue driven by its artificial intelligence initiatives.

U.S. futures edged up marginally in anticipation of a data-heavy week, with investors closely watching upcoming U.S. economic indicators including the ISM manufacturing and services indexes and the August jobs report due Friday.

Median expectations suggest U.S. non-farm payrolls will show a gain of 75,000 jobs, though estimates range from zero to 110,000 due to lingering uncertainty following July’s weaker-than-expected results. The unemployment rate is forecast to tick up to 4.3%.

“The labour market is the number one driver for the Federal Reserve’s next move,” said Samy Chaar, Chief Economist at Lombard Odier. “There’s increasing talk of a rate cut in September, but the data is far from conclusive. It’s a make-or-break week.”

Speculation about potential rate cuts has helped keep Wall Street close to record highs, though historical patterns show September is typically the weakest month for the S&P 500 over the past 35 years.

Trade policy also remained under scrutiny after a U.S. Court of Appeals ruled that several tariffs imposed by President Donald Trump were illegal but allowed them to stay in effect until mid-October, pending a Supreme Court appeal. This ruling could affect ongoing trade negotiations with Japan and South Korea, both of which have encountered recent roadblocks.

Meanwhile, concerns over the independence of the U.S. Federal Reserve resurfaced ahead of legal action by Fed Governor Lisa Cook, who is set to file arguments on Tuesday in response to calls for her removal.

In Europe, political tensions in France drew investor attention as Prime Minister Francois Bayrou began discussions with political leaders in an effort to survive a no-confidence vote scheduled for next week. Market fears over the French fiscal situation had widened the spread between French and German 10-year bonds last week, though it later stabilized at 79 basis points.

“We see more than even odds that the French government will fail the confidence vote,” said Mohit Kumar, Chief European Economist at Jefferies. “This could lead to political instability and possible early elections. We maintain a negative view on France and expect spreads to widen toward 90 basis points.”

Rising fiscal concerns across global economies have been pushing up long-dated bond yields. On Monday, Germany’s 30-year yield hit a new 14-year high of 3.38%, while its benchmark 10-year yield rose to 2.76%.

With U.S. Treasury markets closed, the pressure on European yields supported the euro, which gained 0.25% to trade at $1.1711.

In commodities, gold prices rallied as the U.S. dollar weakened and expectations for lower interest rates supported demand. The precious metal rose as much as 1.1% to a four-month high of $3,489.5 per ounce, following a 2.2% gain last week.

Oil prices inched higher despite concerns about rising global supply and reduced demand due to tariff uncertainty. Brent crude rose 1% to $68.20 per barrel, as supply disruptions linked to intensified Russia–Ukraine airstrikes and a weakening dollar provided some upward support.

Reporting by Wayne Cole in Sydney and Alun John in London

Edited by Himani Sarkar, Muralikumar Anantharaman, Andrew Heavens, and Mark Heinrich

END/WD/AJ/

Comment: